Thailand Public Holidays 2026: Employer Guide to Holiday Pay & Compliance

Plan for Thailand's 2026 public holidays. Master holiday pay, substitute days, and employer compliance rules. Simplify Thai payroll with Slasify.

Key Takeaways |

|

|

|

|

|

Singapore is a leading APAC hub, where staying aligned with Ministry of Manpower (MOM) regulations is non-negotiable. Public holidays in Singapore directly affect payroll, paid leave, overtime and shift rosters, so even small errors can snowball into benefits, insurance and tax issues.

In this article, we will break down Singapore’s 2026 holidays calendar and provide pro tips on what HR leaders can do on staffing and payroll outsourcing for the Singapore market to minimize risks and stay compliant.

Full-time employees covered by the Employment Act are entitled to 11 paid public holidays below in Singapore for 2026:

Note that both Hari Raya Puasa and Hari Raya Haji follow the Islamic lunar calendar and are subject to confirmation (moon-sighting) every year. See the 2026 public holidays announced by the Ministry of Manpower here.

Part-time staff are also entitled to pro-rated paid holidays, calculated based on hours worked.. If agreed by both parties, public holidays can also be encashed and added to the hourly gross pay for the employees.

Public holidays in Singapore can impact staffing and payroll. In 2026, HR leaders should expect leave spikes and shorter approval cycles as there are several long weekends and Monday-in-lieu days. Here we have prepared some pro tips for you on four key areas.

Long weekends and Monday-in-lieu days often trigger spikes in leave applications and reduced staffing coverage, especially in retail, hospitality, warehouse, and on-call roles, where even small gaps are felt by customers. There are many ways to plan to keep operations steady:

For public holidays that fall near salary payout day, your HR team needs to process payroll early to avoid delays. Here are the tips regarding payroll cycles:

According to the Ministry of Manpower, monthly salary must be paid within 7 days and overtime work within 14 days after the end of the salary period. Failing to do so will be considered an offence and may face a fine between S$ 3,000 to S$ 15,000 and S$ 6,000 to S$ 30,000 for repeat offenders. Needless to say, employers must always prepare ahead of time to avoid missing the pay out day.

Night shifts that cross into midnight are one of the trickiest parts to manage. You need to be precise with holiday hours to avoid overpaying for an entire shift. Here are our tips to navigate night shift management:

Singapore public holidays can clash with other regions’ workdays and create handoff gaps. We recommend the following to keep customers and suppliers aligned:

Proper planning around each Singapore public holiday can improve productivity, enhance employee satisfaction, and support smoother business operations.

R. Saranya, Info-tech

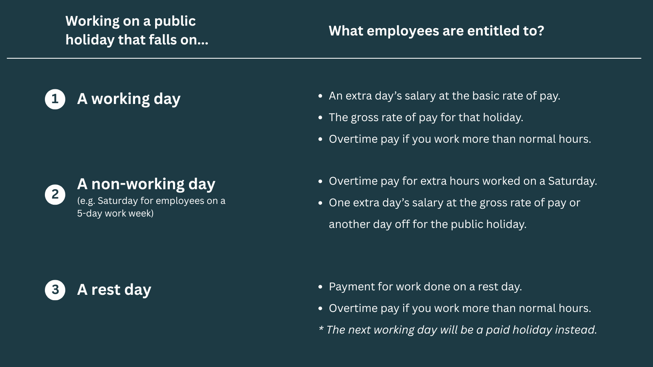

Employers in Singapore must provide statutory holiday pay or a day off and apply the rules consistently. It’s also important to know who’s entitled, how pay is calculated, and when a time-off-in-lieu is applicable, as failing to comply can cause penalties and disputes with employees.

To stay compliant, employers must understand the basic entitlements and substitution rules for Singapore public holidays.

If an employee works on a public holiday, you and your employee can mutually agree to substitute a public holiday for another working day.

If an employee is not covered under Part 4 of the Employment Act, you can grant time-off-in- lieu if the employee works on a public holiday. The time off should consist of a mutually agreed number of hours.

When it comes to payroll and compliance, there are a few levers that keep everything accurate and audit-ready around Singapore’s holidays in 2026. Focus on how you plan payroll and staffing in public holiday weeks, with the four key areas below:

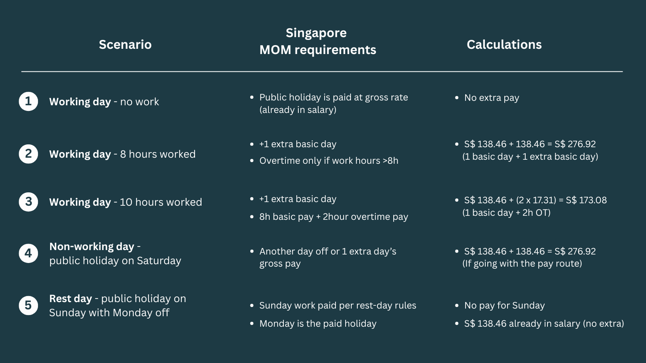

The Ministry of Manpower in Singapore provides formulas for monthly and daily salary calculations. Here is a comparison table to show calculations under different scenarios, using the following assumptions as examples:

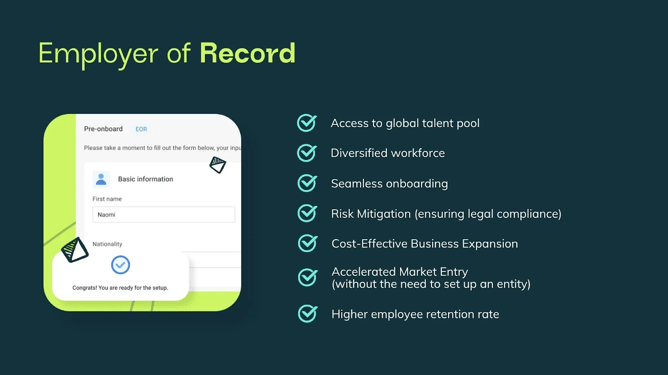

Payroll and compliance are easily some of the most error-prone and time-consuming HR tasks for small- and medium-sized businesses. When public holidays, overtime, and different employee types (full-time vs part-time) come into play, every misstep can complicate payroll, insurance and tax calculations.

That’s why many companies today choose to work with an Employer of Record (EOR) in Singapore such as Slasify, to automate workflows and stay compliant for every Singapore holiday in 2026. Slasify provides trusted HR solutions for the Singapore market with benefits such as:

With 2026 having 11 public holidays and several of them falling on weekends, employers must be prepared for manpower challenges by planning to ensure compliance on all fronts. Failing to have a clear and compliant plan can easily cause unnecessary legal and financial risks for your company.

Book a free consultation with Slasify’s experts today to learn how you can navigate Singapore’s HR compliance regulations to stay compliant and productive.

Employees covered by the Employment Act are entitled to 11 paid public holidays. Part-time staff are covered too, only that their entitlement is prorated by contracted hours.

2. What happens if a holiday falls on a Sunday?According to the Employment Act (Part 10, 88 holiday), in 2026, certain holidays such as Vesak Day and National Day fall on Sundays. How these holidays are treated depends on your employee’s work schedule:

As public holiday weeks usually compress approval and payroll lead time, we recommend moving timecard and overtime approvals forward and processing payroll earlier. You can also run a public holiday check before the cut-off date. Many companies also turn to Slasify to handle payroll outsourcing in Singapore to automate payroll calculations.

Yes, according to the Employment Act, Part 10 s.88(1)(a), employers and employees may mutually agree to substitute a public holiday with another working day.

5. How do contractors’ entitlements differ from full-time employees?

Independent contractors aren’t covered by the Employment Act in the same way. Public holidays and overtime terms depend on the contract. To avoid disputes, document compensation, in-lieu options, and overtime policies in writing. If you’re unsure, Slasify can help assess your situation and provide consultation on employee vs contract risks.

6. What’s the penalty for non-compliance with MOM holiday rules?

While there are no specific rules on violations against MOM holiday compliance, failing to calculate payroll and provide correct leave entitlement can lead to potential fines and employee disputes. The fastest way to stay compliant is to keep everything on record and regularly monitor payroll and time-off situations.

Plan for Thailand's 2026 public holidays. Master holiday pay, substitute days, and employer compliance rules. Simplify Thai payroll with Slasify.

Plan for Malaysia's 2026 holidays! Get the full calendar, mandatory leave rules & replacement guide for Hari Raya & CNY. Simplify payroll with...

Explore Taiwan’s public holidays in 2026: holiday pay, payroll compliance affect HR operations, and plan with using Slasify Taiwan holiday calendar...

Stay on top of the global hiring trends and regional compliance updates with Slasify.